Award-winning PDF software

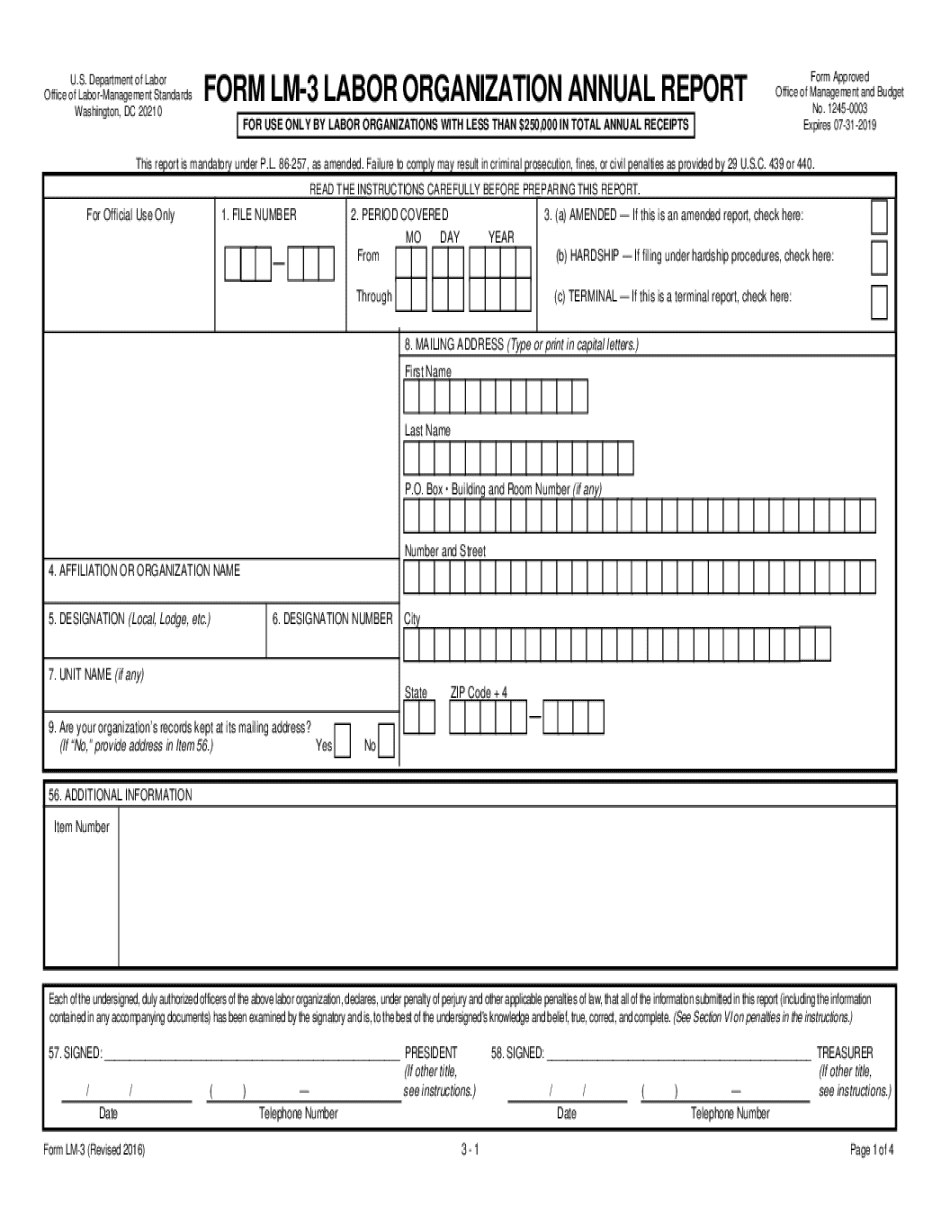

Form LM-3 is a must for any labor entity subject to CSRA, LMRDA, or FSA in the case its overall annual receipts that amount up to a quarter-million USD. Note that the term “overall annual receipts” covers all the labor entity’s financial receipts during the reporting period, including those from special funds.

When is Form Lm 3 Due?

A 90-day period after the end of the entity’s fiscal year is given to the organization so that it can file the document. Note, that an extension is allowed for any reason. If the organization fails to meet the deadline, penalties will be imposed. In the case the entity closes during the reporting term, the final template has to be filed within one month after the date it ceased to operate.

Where to File Form Lm 3

The financial statement must be filled out and submitted in a digital format to the U.S. Department of Labor. The document’s paper version is allowed to be filed only in the case of a continuing or temporary hardship exemption.