An pub is a flowable file designed to be read on any number of digital devices including phones tablets and computers Adobe has been increasingly improving in designs ability to accurately output InDesign documents as pub files, let's take a look at some of the basic things that you should know when preparing a document for pub output. Now I'm beginning this video with the preparing a pub Indy file already open on my computer, but before I go too far I'm going to jump over to my finder, and I'm going to navigate to the chapter 16 folder, and I'm going to click inside the pub folder and within there you'll find a complete version of an pub file. Now I have a program called Adobe Digital Editions installed on my computer already and this is a free pub reader from Adobe, it's very good at displaying pubs in a basic fashion, so I'm going to double-click on that file and that's going to open up my pub inside of Adobe Digital Editions now as I page through this pub we can see that if we compare this to our InDesign layout we do have some formatting however you'll notice that we do in fact lose some of our formatting control when we export to pub. Some of this is by design you see, an pub is designed to be flowable in any number of different devices. Well what do I mean by flowable well right now I'm viewing this particular file, and I'm on this page, and I'm looking at the text and the text is a little hard to read for me so what I can do is I can come up here, and I can increase the text size so that it's easier for me to...

PDF editing your way

Complete or edit your lm3 anytime and from any device using our web, desktop, and mobile apps. Create custom documents by adding smart fillable fields.

Native cloud integration

Work smarter and export form lm3 directly to your preferred cloud. Get everything you need to store, synchronize and share safely with the recipients.

All-in-one PDF converter

Convert and save your dol lm 3 as PDF (.pdf), presentation (.pptx), image (.jpeg), spreadsheet (.xlsx) or document (.docx). Transform it to the fillable template for one-click reusing.

Faster real-time collaboration

Invite your teammates to work with you in a single secure workspace. Manage complex workflows and remove blockers to collaborate more efficiently.

Well-organized document storage

Generate as many documents and template folders as you need. Add custom tags to your files and records for faster organization and easier access.

Strengthen security and compliance

Add an extra layer of protection to your lm 3 form by requiring a signer to enter a password or authenticate their identity via text messages or phone calls.

Company logo & branding

Brand your communication and make your emails recognizable by adding your company’s logo. Generate error-free forms that create a more professional feel for your business.

Multiple export options

Share your files securely by selecting the method of your choice: send by email, SMS, fax, USPS, or create a link to a fillable form. Set up notifications and reminders.

Customizable eSignature workflows

Build and scale eSignature workflows with clicks, not code. Benefit from intuitive experience with role-based signing orders, built-in payments, and detailed audit trail.

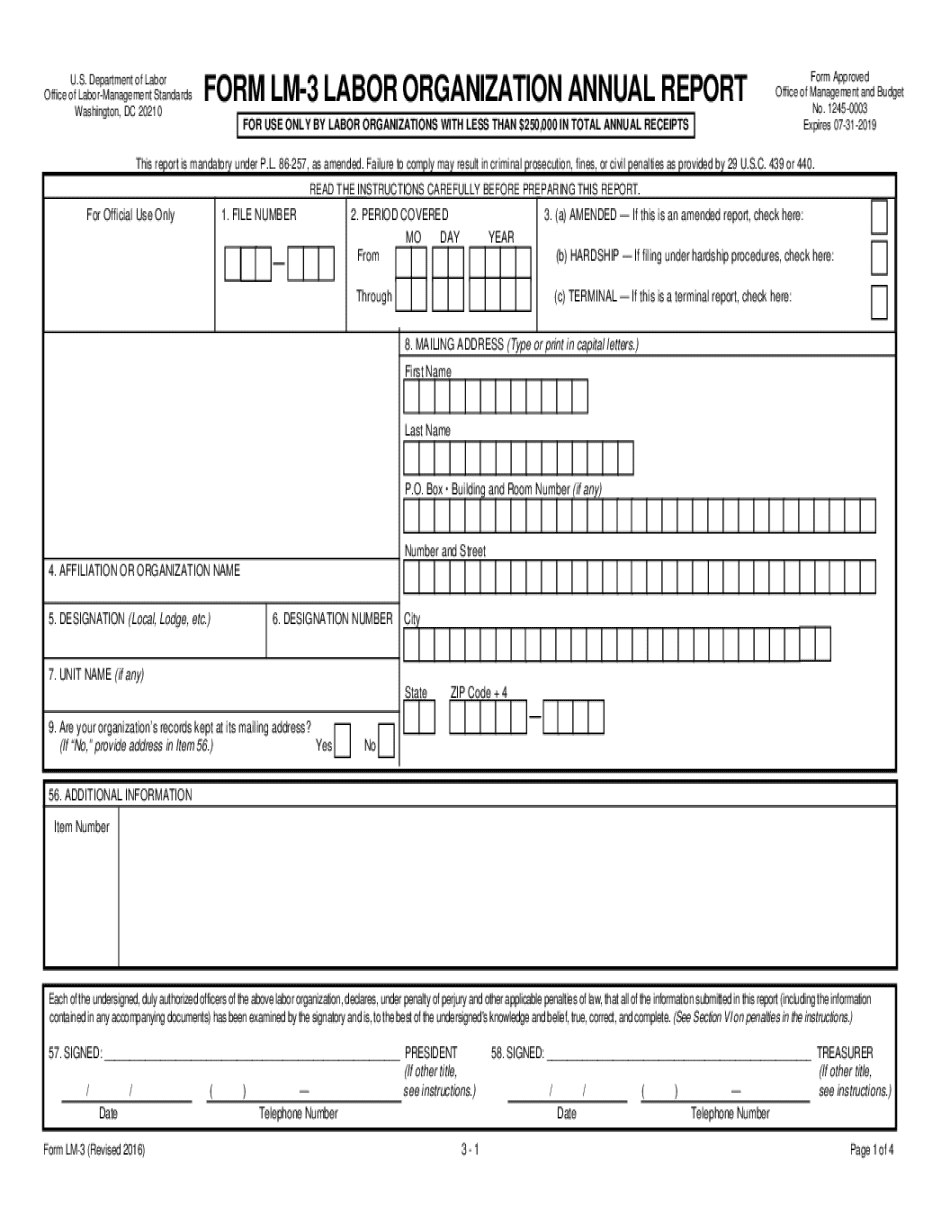

What you should know about LM 3 Form

- LM 3 Form is for labor organizations with less than $250,000 in total annual revenue.

- The form is used for reporting annual financial information.

- LM 3 Form must be filed electronically for accuracy.

Award-winning PDF software

How to prepare LM 3 Form

About Form LM-3

Form LM-3 is a financial disclosure form that labor organizations are required to file with the Department of Labor (DOL) under the Labor-Management Reporting and Disclosure Act (LMRDA). The purpose of the form is to provide information about the organization's financial activities, including income, expenses, and assets. Labor organizations that are subject to the provisions of the LMRDA and whose annual receipts are $250,000 or more are required to file Form LM-3 with the DOL. This includes national and international unions, as well as local unions and other labor organizations such as employee associations and labor federations.

How to complete a LM 3 Form

- Make sure to provide accurate and uptodate details

- Next, report any financial transactions and activities for the year as required by the form

- Review all entries carefully before submitting the form electronically

- For more detailed instructions, refer to the guidelines provided by the US

- Department of Labor Office of LaborManagement Standards

People also ask about LM 3 Form

What people say about us

Complex paperwork, simplified

Video instructions and help with filling out and completing LM 3 Form