Award-winning PDF software

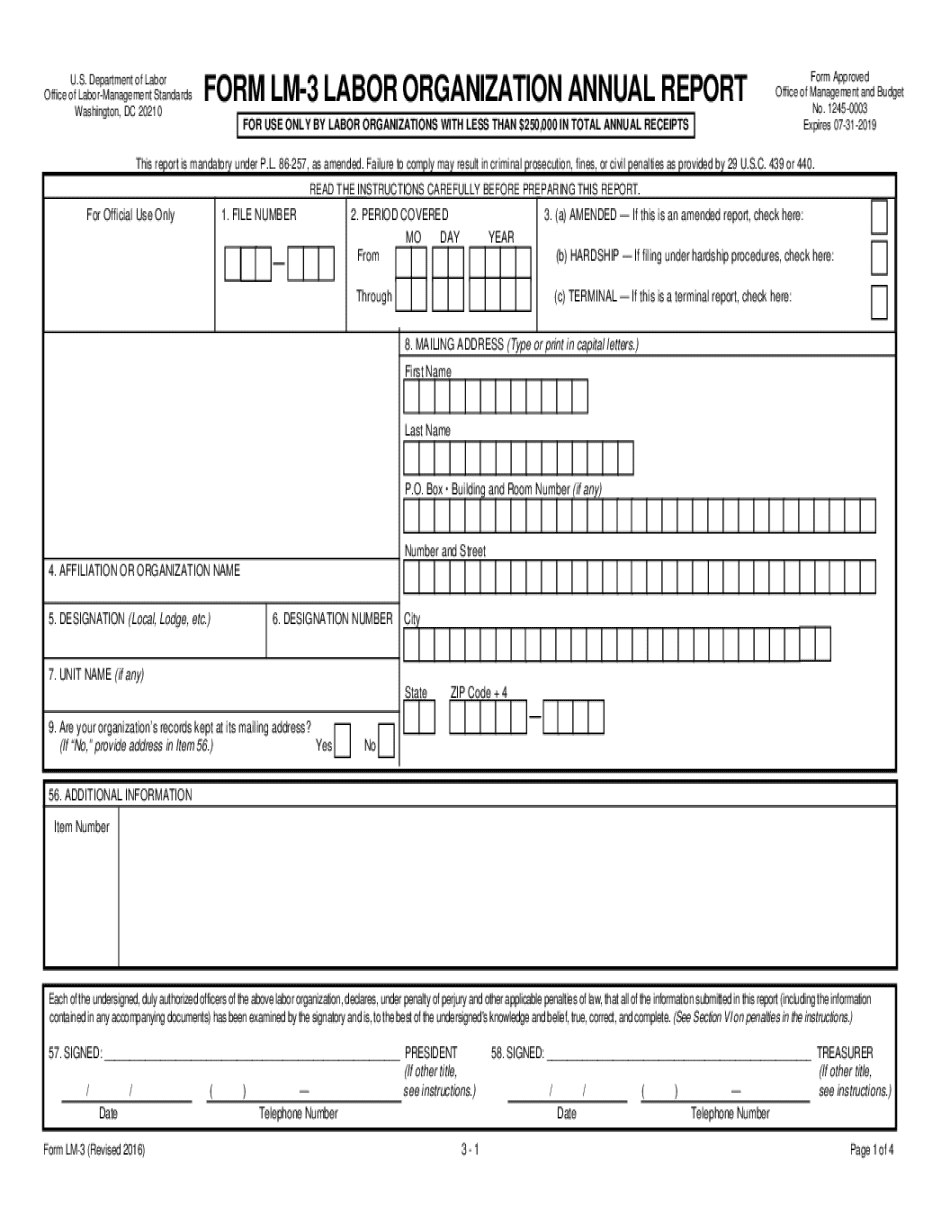

Form lm-3 labor organization annual report

A. CIVIL- ACTION LAW. S 3369. DEFINITIONS. As used in this act, the following defined terms shall have the meanings attributed to them in this section unless the context otherwise requires: 1. “Apprentice” means any person who is, or has ever been, an employee in any office that has the authority of the executive director or a member of the executive or professional staff of the board, or who has been appointed at the request of the executive director or member by a board committee. 2. “Appraised valuation” means any valuation in a form approved by the board. S 3371. DEFINITIONS FOR APPLIANCE RETAILERS. For purposes of this act, the following definitions shall apply: (a) “Associated manufacturer” means a merchant that produces or supplies one or more products or services under the same, specific brand name, in the course of trade or commerce within this commonwealth; (b).

- form dol lm-3 fill online, printable, fillable

The problem here is that the form is so vague. If there's a requirement that the organization should have an office somewhere. . . Then that's good news for non-profits. If the office doesn't exist, then that's bad news. The Form LM-3 lists a lot of the stuff that needs to be in a financial statement, but then fails to provide a lot of detail on how things were accumulated. So it's impossible to ascertain the value of various assets. It's hard to know how many people are involved in the organization. And if it isn't clear to the reader just what those assets are, how do you know what you're worth? And all this has to be disclosed even if it's a foreign charity. Not all forms are created equal. And when an organization's filing status is not clear, or if its filing status is in doubt, it.

Guide to preparing the lm-3

It is intended for non-experts and is included in the. In this tutorial you'll be writing three custom rules that will help determine whether an individual who is a member of a labor organization is entitled to any benefits from the organization. You'll be creating rule rules that help determine the date certain benefits would be due, and when those benefits are due, for that individual. You'll begin using the “Get to Know Me” form, a free online tool that allows you to create and sign paper forms for online filing. (See this guide for more information about using the online Get to Know Me form.) We'll start by creating simple rule rules that help to determine whether an individual (and potentially, an entire workplace) is eligible to receive a specific benefit. If the benefit is paid for by employers or employees, the employee does not have to be included for.

Preparing and finalizing form lm-3 for labor organizations

PDF files (which I assume these file extensions are) then the new form will need to be completed by February 10. This is too late for the Form LT-1. The following should be a quick .pdf conversion for .pdf and then a form LM-3 is uploaded to the .org domain. Note : .pdf files are generally the most expensive to create/upload/publish and the forms can be a costly headache for the federal and state government. This form can only be completed by a member of a labor union and/or by the registered representative of the union, not by someone who does not belong to the union. Form LM-3 is filed with the IRS. The original form is not needed because an amended copy is required to file the Form 1099. I have not found a current form LM-3 for the United Food and Commercial Workers (FCW). They will be filing an updated form LM-4. .

Mandatory electronic filing for forms lm-3 and lm-4 - calibre

The changes to the forms have been made by Treasury Secretary Jacob Lew and IRS officials. We now return to our first question about the impact of those changes: Will those changes make it more difficult for IRS to assess a taxpayer's tax liability? Yes, because any taxpayer with a “significant burden” of completing Form 1040-ES, Form 1040-ESX, or Form 1040A-S must now file a paper form, and do so electronically for each return for which a paper Form 1040-ES, Form 1040-ESX, or Form 1040A-S is requested. (See the text box below on “Paper Form1040-ES and 1040A-S Requests.”) (2) The additional time that it takes to file those forms means that IRS will have to be “clearer” in informing taxpayers of their filing requirements. This will make taxpayers less responsive, since they will be trying to find excuses for missing a deadline. For example, a person may be.