Music, welcome back to Solutions for Financial Independence. Joining me today is John Halterman from Beacon Wealth Management. Hi John, how are you doing today? Hey Vanessa, I'm doing well. How about you? I'm doing good. So today's question comes from Terry from Weston. I heard you talk a lot about the Department of Labor's fiduciary standards that were going to be put into place. Whatever happened to those rules, and do advisors have to follow them? Hey Terry, I'm glad you asked because fiduciary standards, especially uniform fiduciary standards, are definitely something that's much needed in our industry. Because over the years, advisors, what I consider to be salespeople, have been notorious for being product salespeople versus providing professional advice. And our industry definitely needs to have fiduciary standards for all products, to put the interest of the client first in all situations. Now, I've got to tell you, the fiduciary standards that were proposed have actually been axed. The reason why is that the Obama administration was just a little overzealous. They probably overstepped their boundaries because they made it to the Department of Labor, which means it only affected qualified accounts such as IRAs and 401ks. It should be applicable to everything. So when the Trump administration came in, they basically axed it and said, "Okay, we're going to do this the right way." And so now it's being done by the SEC, who runs the securities industry and who should have already done this type of fiduciary standards. So during the process of coming out with new standards, definitely all advisors, it's going to be applicable to them. It's definitely going to be something that's in the interest of the client, but at the same time, fair to the securities industry. And so I'm looking forward to it. It should roll...

Award-winning PDF software

Department of labor lm 10 search Form: What You Should Know

Annual Report — U.S. Department of Labor Learn more about ALMS's Public Disclosure Room at: The online public disclosure room in the Office of Labor-Management Standards (ALMS) is available to the public 12 hours a day, 6 days a week, from 12:00 a.m. until 12:00 midnight, Mon. — Fri. Except statutory holidays, or 24 hours a day, from 6:00 a.m. until 6:00 p.m., on weekends. A. The public disclosure room is open to the public during regular business hours of the Office of Labor-Management Standards. B. The public disclosure room is accessible in a wheelchair with the assistance of an attendant. It is not accessible to individuals with restricted mobility. C. You are required to pay the following fee: 150 for filing the Form LM-10 Employer Report (Form LM-10). D. Please return the Form LM-10 for the public disclosure service to the Department of Labor. D. You are responsible for paying any costs associated with the public disclosure service. The Department of Labor's public disclosure room is located at: E-mail to DOLPublicDevel-at-govdol.gov is available for general questions about form LM-10 or the Public Disclosure Room at: If you want to use the public disclosure service or would like to request an employee/employer report, or to file a Form LM-10, you must fill out and sign the required form and mail it to: Public Disclosure Room POLLS, P.O. Drawer 437 Washington, D.C. 20210 You are required to sign Form 5500-1 (General Inquiry). The form contains information needed to identify you, provide your name, and provide your address. Form LM-10 and other forms available for public viewing in the public disclosure room, including the U.S.

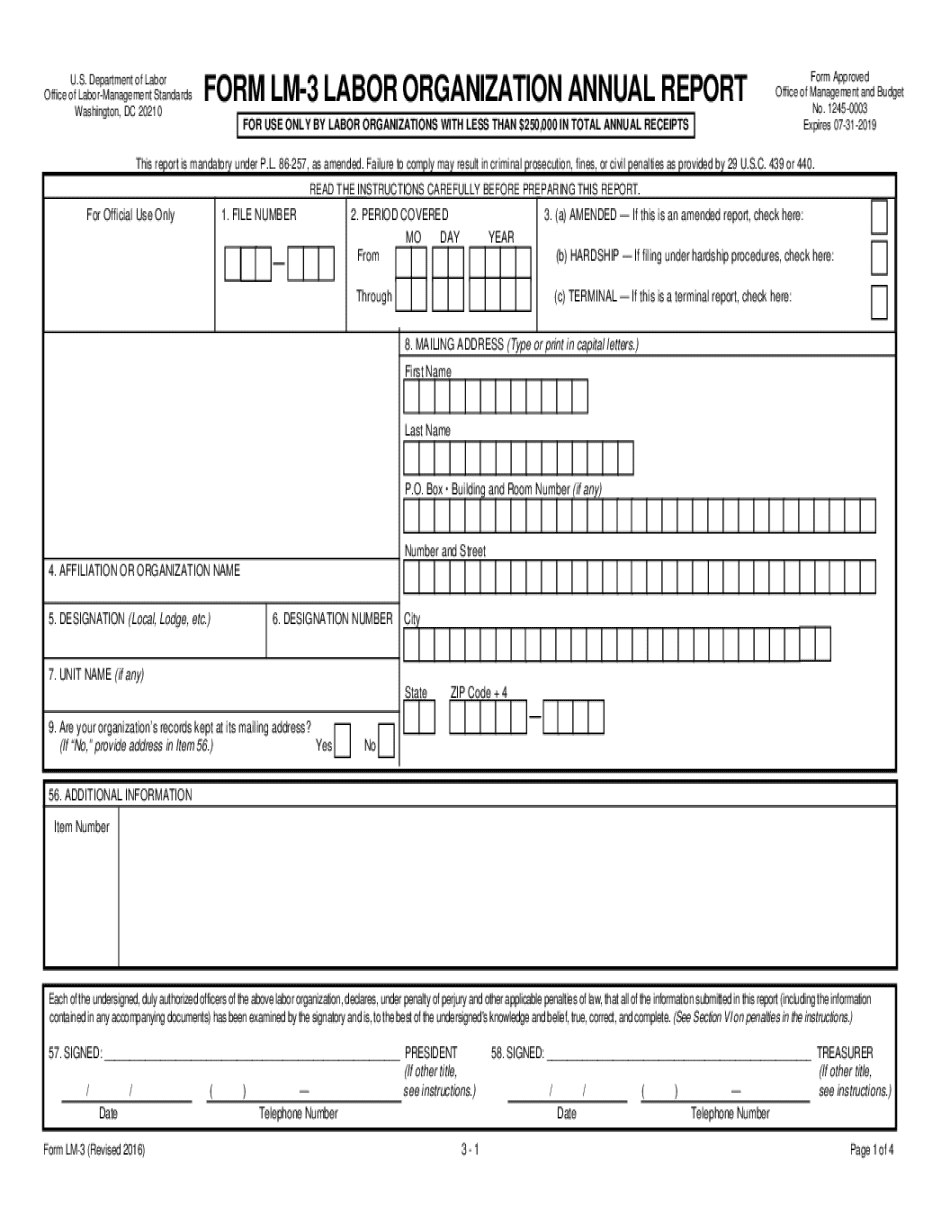

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form LM-3, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form LM-3 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form LM-3 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form LM-3 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Department of labor lm 10 search