The early half of the 20th century saw a rapid rise in labor union membership. But today, only about 1/8 of American workers belong to them. What happened to the American union? Labor unions began as a way for the common worker to achieve collective bargaining power against employers for higher wages, safer conditions, and better hours. Some unions, such as the Industrial Workers of the World, were focused not only on those goals but also on creating a united working class. Others, known as bread-and-butter unions, were solely focused on achieving better conditions. Collective power was often enforced in the form of a strike, a practice still common today among public school teachers and transportation workers. Workers would band together and agree not to work until employers gave in to their demands. In the early days, these strikes could turn into violent riots. Today, most unions settle conditions directly with the companies through striking and negotiating. Unions were able to achieve many victories for their workers. Today, sectors like public education and the auto industry are heavily unionized, but many other private sector jobs no longer have a large union influence. One possible reason is government action. Certain labor laws have made unions seem less necessary. For instance, with the passage of the Occupational Safety and Health Act, workers no longer needed to depend on unions to report unsafe conditions. Meanwhile, other laws have limited what unions can do. The Taft-Hartley Act of 1947 placed restrictions on certain union bargaining tactics, like striking. Many companies also offer benefits that were once traditionally brought about by unions, such as pensions. The decline of unions may also be tied to larger changes in the global economy. Some industries have seen jobs move overseas or be replaced by automation, resulting in the loss of many...

Award-winning PDF software

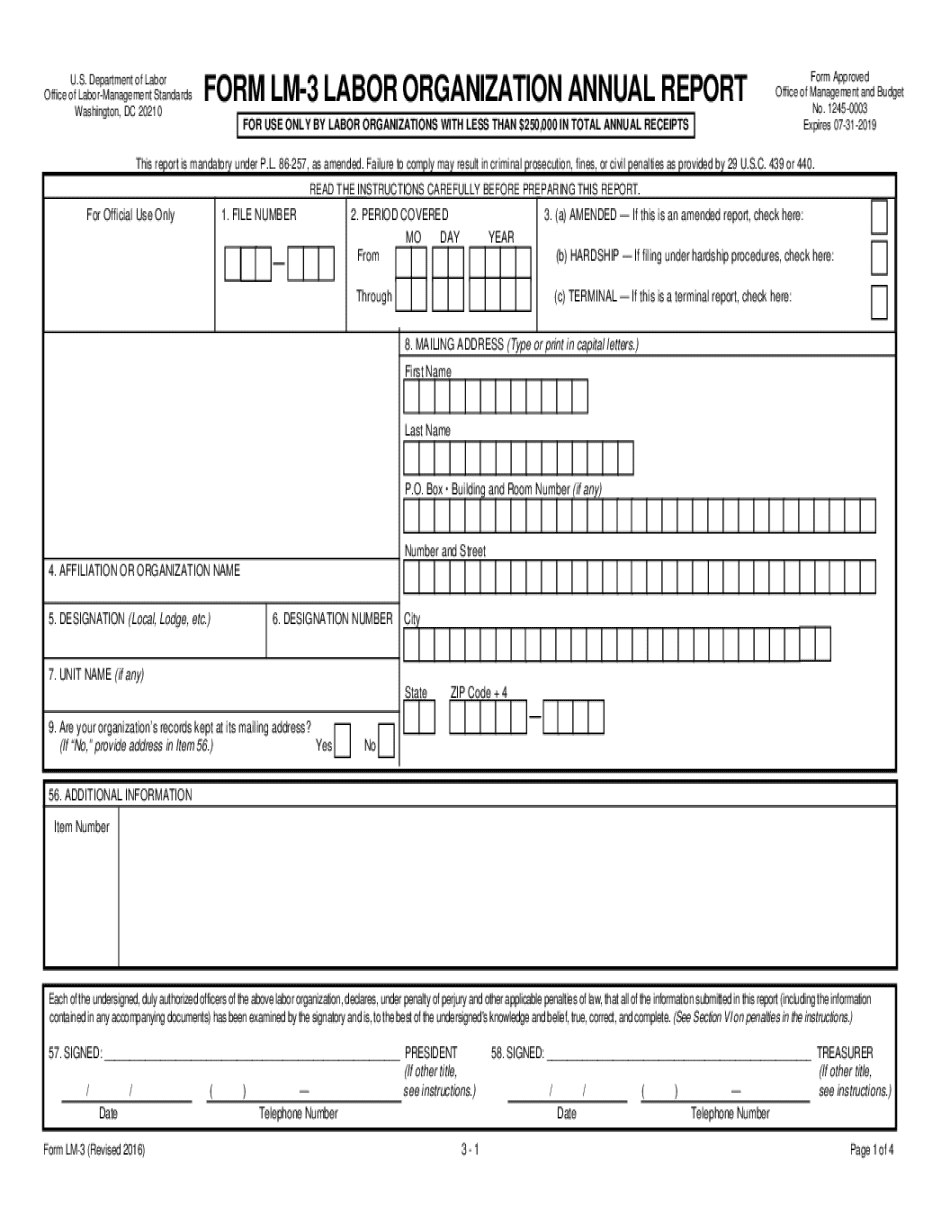

Labor union audited financial statements Form: What You Should Know

If the union's assets exceed 40,000 in any one year, they also must file Form LM-3, which must report its investments of at least 50,000 in one calendar year. The Form LM-3 (and the corresponding Form LM-2) must also include all assets (in stock and other forms of interest) greater than 5,000. These reports are due by January 15 of the subsequent calendar year. Labor Organization Annual Financial Reports: LM-2, LM-3 Dec 13, 2025 – 7.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form LM-3, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form LM-3 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form LM-3 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form LM-3 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Labor union audited financial statements