Award-winning PDF software

Us dol lm reports Form: What You Should Know

S. Treasury obligation or to effect the bankruptcy, if the labor organization is a bank or trust company, bank holding company, insured bank holding company, or trust company and the property is lawfully assigned to it prior to its termination Report details of any cash settlement of employee claims to employees for any period not exceeding three years from the time the claim was alleged or established, or that have been adjudicated but not paid, except claims arising from a loss of service performed for a period of no more than 13 days during a fiscal year; and a claim for a loss of wages during a fiscal year for a period for which the employee had the right to be paid (but does not have the right to be paid because the worker was absent from work), and any similar claim, if the amount of the claim exceeds 100; or Report details of any payment that an entity other than the labor organization made, received, or was due or was otherwise owed, as well as the name, social security number, and number of the employee to whom the payment was made, and date of a payment received, if the payment involves the exchange of personal property; receipt by the labor organization of a paycheck or other compensation, other than wages; or any other transaction in which any of the labor organization's officers acted as general agent of the employer Report details of all cash transfers, except those involving the exchange of personal property; income taxes; tax receipts for any period not exceeding six months from the time the tax was assessed; and a claim for any amount of unpaid tax, except for any income tax assessed on your organization, for any fiscal year, if the amount of the assessment exceeds 50; and a claim for any unpaid tax, if the tax was assessed on your organization, for any fiscal year, if the amount of the assessment exceeds 500 Report details of the sale or redemption by the labor organization of U.S.

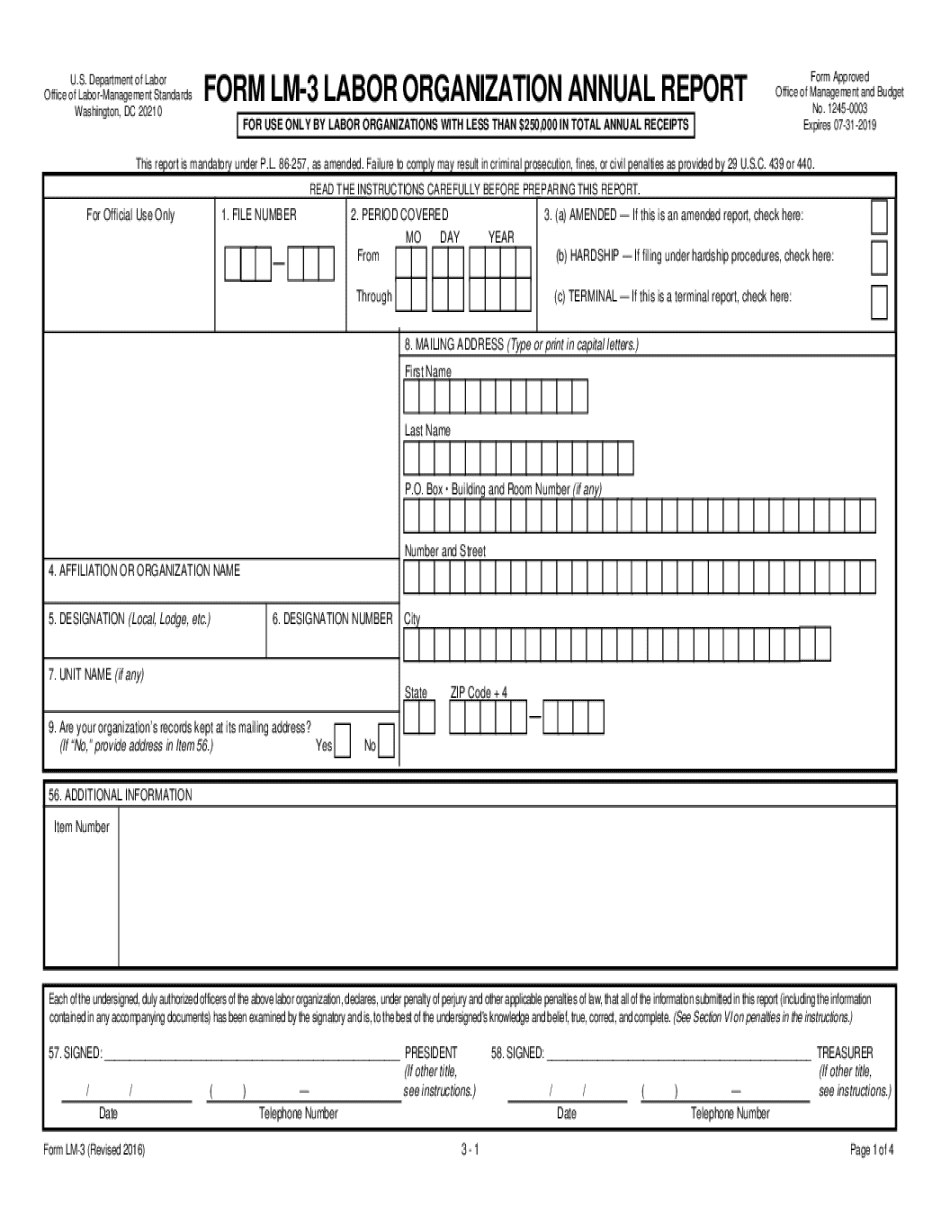

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form LM-3, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form LM-3 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form LM-3 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form LM-3 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.